Inside India’s fashion retail industry with Ekta Biyani, Co-founder of Style Union

With a population of 1.4BN, India is slated to become the world’s most populous country within 2023. We asked Ekta Biyani of Style Union what we can expect of Indian fashion and apparel retail and what it will take to succeed in a market on the brink of head-spinning growth.

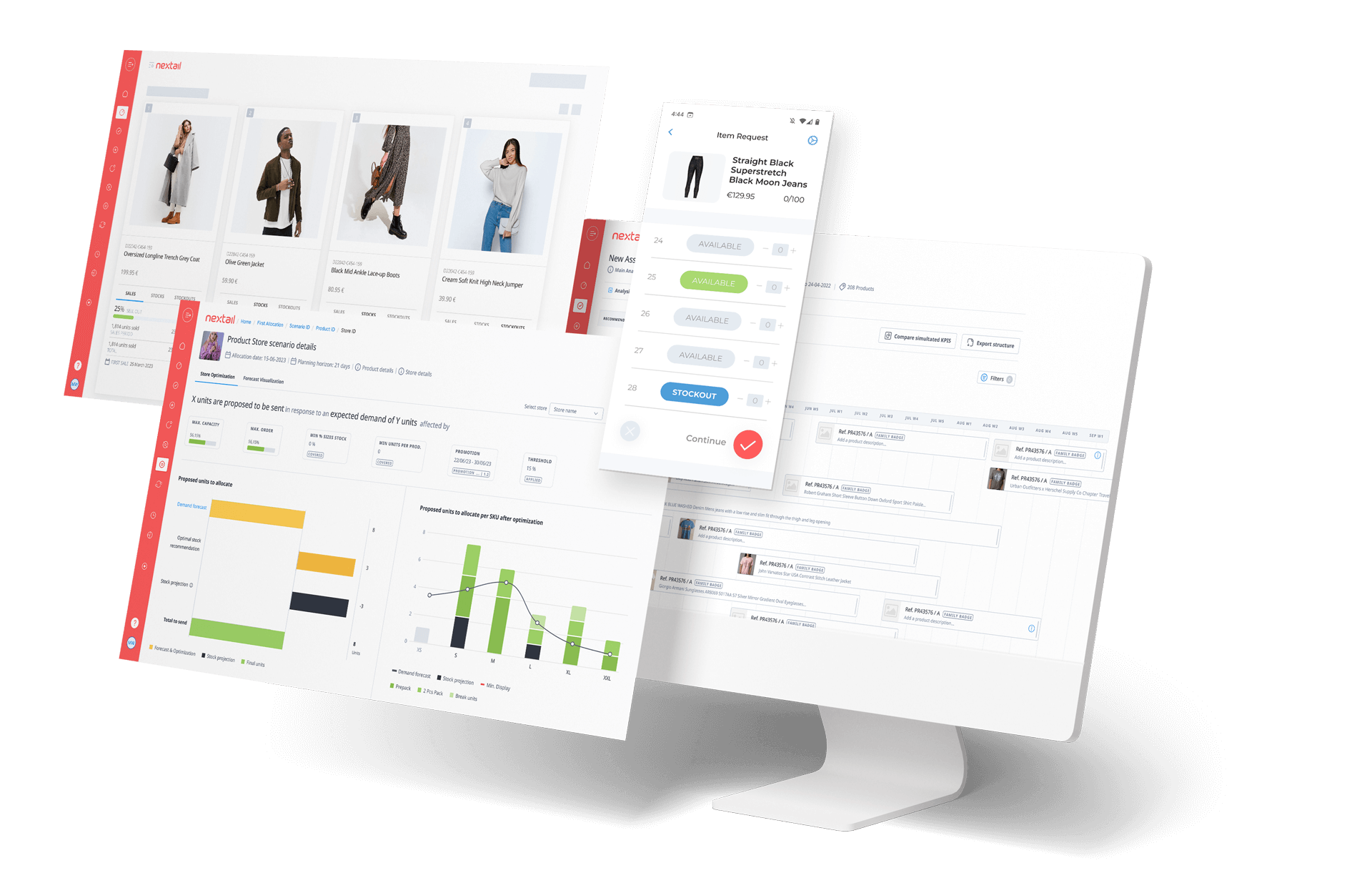

Read the case study about how Indian fashion brand Style Union is taking a centrally-led and automated approach to core merchandising decisions and achieving 13-week coverage and an inventory ratio of 4 with Nextail.

Question #1: What will fashion retail in India look like 10 years from now?

The next 3 to 7 years are going to be very exciting. For one, the per capita income in India is constantly rising and this year, we’ve crossed a very crucial milestone of $2,000 per capita which typically signals strong consumer spending growth, especially on aspirational categories like clothing, footwear, lifestyle, accessories, health, and beauty products.

And of course, while 1.4BN is the headline number, not everyone lives in urban areas today. In the near-term, we expect an additional 300-400 million people to cross into the consumption bracket and become first-time shoppers in the next 7 to 10 years. As Indian fashion retailers, our focus will be on how to understand and serve them as first time shoppers.

Note from editor: In a world of 8BN people it’s useful to see numbers in context. Readers may find this infographic that plots the population of India’s states against countries useful.

Question #2: Where will most of Style Union’s growth take place?

Style Union is a value-fashion brand that takes pride in delivering customers a unique shopping experience driven by the efficiency of our core merchandising processes. Our strategy revolves around offering the right products to customers while maintaining lean inventory levels. This enables us to effectively meet demand, and uphold a clean and decluttered visual aesthetic in our stores.

We’re on an ambitious journey of opening nearly 200+ stores by 2025. In the short-term, we will be focused on serving India’s fashion customers in the T1 cities like Bangalore and Hyderabad which have established customer bases. But it’s not just about being there, we’re also looking at opening many more Style Union stores closer to customers across India.

The stunning number of mobile devices and smartphones in use in India mean that information about fashion and trends, especially via social media and influencers, is permeating Indian society faster than ever before. This in turn is driving demand with shoppers wanting a store “next door” that offers the latest trends at reasonable prices.

Notes from editor: India classifies its towns into T1, T2, T3 based on population density. By 2047, 50% of the Indian population will live in urban areas.

Question #3: How will Style Union take advantage of growth and capture first-time shoppers?

This is something we’ve been thinking deeply about. How can we help them make this transition? How do we teach them about clothing styles and trends? But more importantly, how do we ensure proximity at the point of consumption?

For example, we will be focused on helping Indian fashion customers to understand value. Instead of hesitating to make a purchase assuming that items will be offered later at a lower price, Style Union is already able to offer products at the best value thanks to the efficiency and speed of our supply chain.

India possesses the advantage of being among the few locations globally where production and consumption occur on a national scale. This self-contained ecosystem enables us to overcome issues typically associated with global supply chains.

Additionally, it grants us a unique advantage in terms of sourcing and selling locally, ultimately aiding in maintaining low costs for our customers.

Remarkably, the entire process from factory to warehouse to store can be completed in under five days, allowing us to offer fair prices without having to sacrifice quality.

Question #4: What’s the biggest challenge to scaling retail models?

The biggest challenge in retail has always been having the right product at the right time, at the right place and the right price. It’s not a new challenge, and it’s not unique to India.

We know it is about optimizing and creating the most efficient supply chain and using data to predict what is going to sell in stores with the most demand. But as businesses grow, the number of permutations and product combinations you have to calculate for increase, seriously increasing the complexity of managing your inventory.

At Style Union, we believe that the use of evolved technologies is the right way to move forward, so our focus has been on adopting some of the best-in-class technologies being used in the rest of the world, and using them from day one. That way, the algorithms start understanding patterns that are emerging out of our stores and over time, the data we’ve been collecting will help us continue to grow.

Additionally, with this tech in our DNA, we don’t have to deal with legacy systems or processes. We don’t need to retrain our people. We’re training our people in the new world and we are quite hopeful that the road we’ve taken in terms of building the systems and processes in the way that we have will make it a very relevant business in the next 10 years.

Question #5: What should international retailers know before entering the Indian retail market?

Many international retailer will be wondering if now is the right time to invest in India. Every market has its own challenges and opportunities. India is no different. Even we, as Indian retailers ourselves, can’t say we understand all Indians.

But the job of a good retailer is to spend time understanding consumers.

Retailers entering India’s fashion market for the first time should understand that Indian identity and culture is very strong and also very different from other parts of the world. It won’t be a matter of assuming that something that works in one part of the world will work here. Even McDonald’s has had to adapt!

Just walk into any McDonald’s in India, and you’ll see that the majority of the menu is made up of items that you won’t find anywhere else. The word “spicy” appears 10 times: spicy chicken wraps, Piri Piri McSpicy Burger, and more! About 10 years ago, they realized that Indians weren’t going to adapt to them, as had been the case in other countries. It would have to be the other way around. It’s taken McDonald’s nearly 30 years to get it right in India.

I would therefore recommend that any international retailer looking to enter and succeed in the Indian market look for a local partner who can help reduce cultural and other barriers to entry.

Read the Style Union case study to learn how the partnership between the growing retailer and Nextail led to an inventory turnover rate that’s 4x faster than the industry standard.