How can retail tech unlock e-commerce growth? Retail executive, Jan Heere, explains

The rise of e-commerce and development of digital channels is unstoppable and retail technology is the enabler that can unlock future growth.

That’s according to Jan Heere, a retail industry heavyweight who has held such positions as CEO at Studio Moderna and Global Managing Director at KIKO MILANO.

Jan shared his insights and predictions on the direction of the industry, highlighting the priorities of retailers moving forward, as well as how disruptive players like Shein are shaking up traditional strategies.

See more insights from “The Big Debate” roundtable of experts including Gita North, Partner at First Friday, and more.

How will retail look in 3 years’ time versus today?

The rise of e-commerce and development of digital channels is an unstoppable trend everywhere.

While there is some nostalgia for traditional retail and a return to physical stores coming out of the pandemic, I’m not certain whether that is a longstanding behavioral change or simply a post-Covid response because we were inside so much and not connecting with our peers and friends and now we need to return.

I think there’s definitely going to be some form of physical retail. There will be a demand for ‘triple A’ retail destinations, such as big regional shopping malls or very central locations with a great tenant mix, offering entertainment and the best brands. However, any retail strategy must combine those elements with e-commerce but by adding physical retail to e-commerce, not the other way around.

How are recent unexpected disruptions changing retail priorities?

Retail is moving much faster as a result of digital resources, with the likes of the Chinese fast-fashion brand Shein bringing the manufacturer and customer much closer together, for example. That’s shortened the supply chain and probably reduces the need for a specialized retail chain or brand.

Manufacturing bases will also be much closer to home. Pressure on supply chain costs from the Far East has put Western Europe back on the map in terms of production, which plays well with consumers who are more conscious in their buying decisions and concerned about where product comes from.

That provides a bigger opportunity for European producers more focused on quality and sustainability. This will be particularly pertinent for brands targeting Gen Z customers concerned with sustainability issues, for whom many equate with fast fashion, and is helping brands that are totally sustainable become more relevant.

What role will technology play in retail transformation?

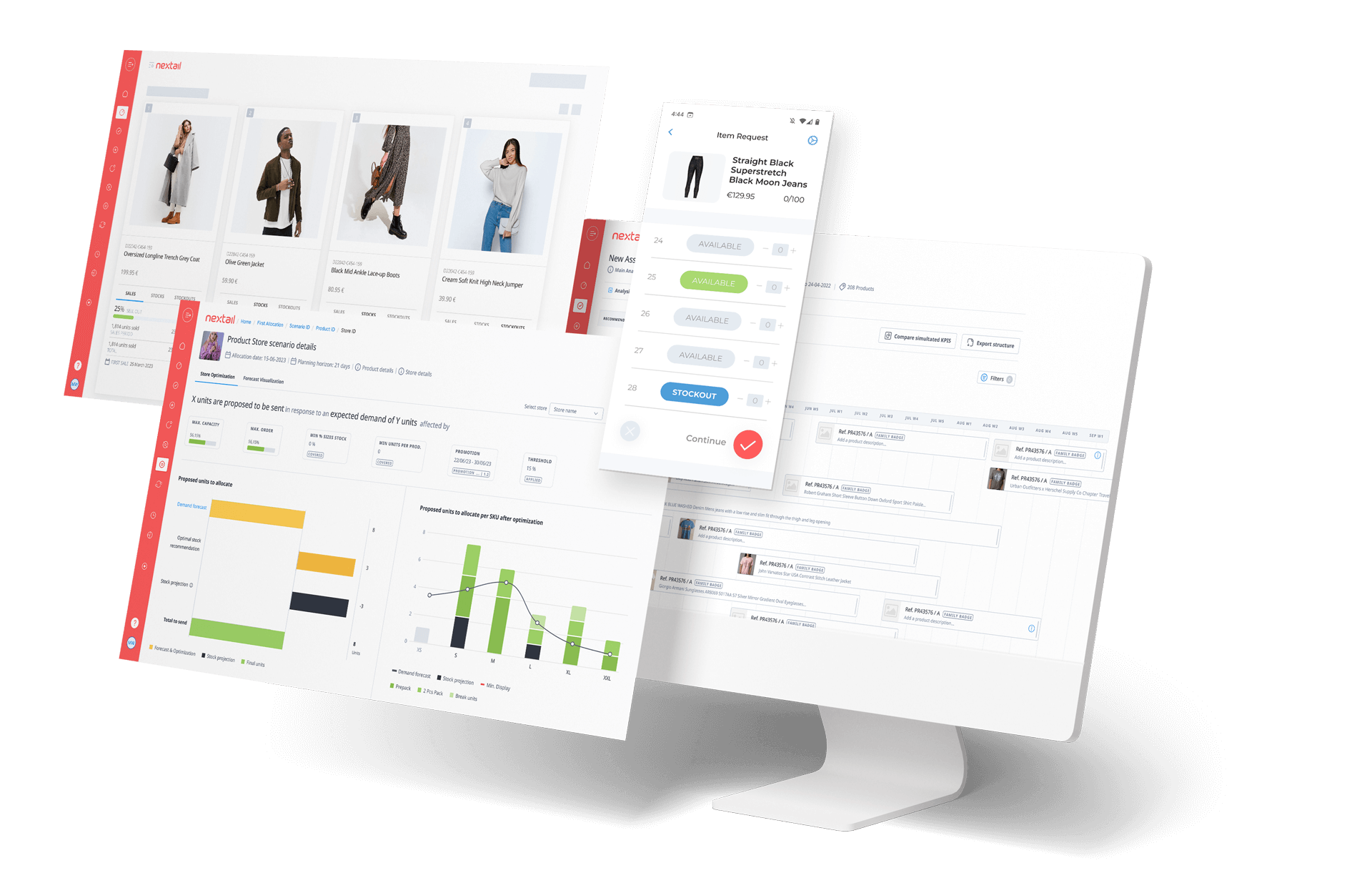

Retail technology spans the entire retail organization. It has played a role in the evolution of stores with touch screen ordering and magic mirrors, for example. Technology is also helping to provide a better customer experience in-store with checkout free solutions – as seen at Amazon Go – helping to reduce friction points.

Going forward, technology will play more of a ‘back office’ role by giving retailers complete product traceability – from knowing where a garment has been produced to understanding their stock availability.

Technology can also resolve some of the HR challenges in retail by automating processes such as self-checkout and with sizing solutions, which help reduce the percentage of returns.

How must retail businesses change to future proof for 2025?

Digital capability is the top priority for retailers in 2023 but that means more than a website – it requires training in IT and supporting a change in business culture towards a digital culture.

I have overseen implementations in different organizations and you can’t underestimate the importance a cultural shift at a company plays in the success of the process.

Organizations typically believe people can make better decisions because of their experience and that they know their customers and locations, even though the metrics show otherwise. This is the first cultural shock and the challenges in implementation tend to be more around this type of conversation rather than the implementation itself, and the results, because it’s very measurable.

The consistency of decision making and agility that tech provides should not be underestimated either. Technology is allowing retailers to move faster than ever. I oversaw the implementation of Nextail at one brand which was suffering an overstock problem after expanding to 1,000 stores. In the past, this could have easily killed the company, but the technology allowed us to act at speed and correct the situation. Furthermore, the replenishment algorithm fuelled a 7% increase in like-for-like sales at the same business.

What tech advances could bring value to retail in the future?

Understanding customer trends and connecting that demand, through buying, back to the manufacturer would be the next logical step in tech evolution. I envisage a future where a tool will connect with Instagram, for example, to capture the brand looks which consumers are liking, then links back into manufacturing to determine the availability of raw materials and capacity in production etc in order to produce a lead time for the customer.

In addition to closing the loop from pinpointing customer trends back into manufacturing, tech may need to evolve and approach distribution from a digital angle for the big online players like Boohoo and ASOS. It could also play a role as a balancing tool for online retailers and marketplaces and helping retailers to understand which products they don’t need to replicate and to make recommendations, for example.

And, if retail is going to disappear in certain locations, then the next tech has to serve a digital platform in order to optimize the location of the goods and the demand from customers plus the relationship with suppliers.

More insights from “The Big Debate” roundtable of experts including Javier Figar, former CRO of AWWG; Carlos Abellán, Data Analytics & Transformation Director at TENDAM, and others.