How omnichannel has evolved in 5 years: A fluid path to purchase

Five years ago, offline and online channels were seen as two different customer journeys, though the lines between them were starting to blur. Today they’re almost indistinguishable. A shopping journey that starts online may end offline or vice versa. Either way, it shouldn’t be something customers spend time thinking about.

What does this mean for retailers’ investment priorities and for customers who used to a shopping journey that gets more seamless every day?

2014 – Offline and online: Mortal enemies?

Two journeys start to merge

Back in 2014, most traditional retailers had at least a minor presence online. However, many still viewed the online and offline customer journeys as separate, bordering on divergent, customer journeys.

While in the US 93.5% of sales occurred in brick and mortar locations, there was still a waft of “showrooming” fear in the air as more shoppers than ever were equipped with mobile phones during their in-store journeys.

Reports mentioned a blurring of channels, and speculated about how long it would be before Amazon opened its first physical stores. Many retailers understood omnichannel to be the solution, but often took it to mean simply connecting points between disparate business areas.

Geographical differences in adoption rates and priorities

But while North American and European markets were trying to merge physical with digital, the opposite was taking place in China, where 11% of retail sales were carried out online.

The government’s 12th Five-year Plan (2011-2015) focused on strengthening domestic consumption through strong government support of the e-commerce sector, while also increasing broadband and 3G coverage across the country.

Since online platforms were cheaper to set up, many Chinese retailers did that instead of investing in more costly physical infrastructure. That meant that Chinese consumers and retailers have essentially bypassed an entire generation of technology with the likes of e-commerce giants Alibaba, JD.com, and Tencent investing in their own tech development.

Just take Tencent’s “super app” WeChat that leapt into e-commerce in 2014 when Tencent invested in major Alibaba competitor, JD. The app had already been integrating payments since 2013.

In Europe and the US, the success of most digital investments were still being measured their ability to drive on-device purchases. There was talk of creating “an integrated digital platform that would allow access to user-specific data across multiple devices, enabling users to access their info anywhere, anytime”. Often, this just meant an app.

Emphasis was often also placed on implementing what we would consider basic usability in today’s standards, such as fewer necessary clicks, sameness across screens, and responsiveness. Understandably so, as only 20% of Internet Retailer’s top 500 mobile retailers had a responsive website at the time.

Digital priorities in China focused on fully integrating social media as part of a brand’s overall strategy and developing interfaces that worked well on multiple devices. This came as purchasing on PCs and tablets was moving to smartphones.

In general, there was little attention paid to just how much digital devices and channels influenced a shopper’s online and in-store path to purchase.

Deloitte found that the “digital influence” factor actually affected $1.1 trillion in-store US sales and reached $1.7 trillion, or 47%, by the end of 2014. In China, digital technologies influenced roughly 59% of offline sales.

2019: Online and offline: One and the same

Omnichannel: Everone’s in on it

Five years later, the landscape is drastically different. Not only do many major retailers now consider, or at least call themselves, “omnichannel”, they are dealing with a customer base that knows they can have it all.

While “omnichannel” has always meant having both an online and offline presence, today it is understood as the full unification of different touchpoints within the customer journey that allow shoppers to transition between physical and virtual stores seamlessly and with no breaks. No breaks!

In terms of the digital journey, however, western retailers could learn a thing or two from Chinese retailers. While digital unification has advanced significantly, the overall purchasing journey is still a big jagged when compared to that of Chinese apps like WeChat who have essentially integrated the entire shopping journey into a single platform.

A brick and mortar revival?

In western markets, true omnichannel retailing is clearly not just the concern of traditional retailers. In Q1 2018, Amazon reported $4.26bn in revenue from physical retail – more than traditional physical giants Sears or JCPenny.

Even pure-play online D2C brands have gone from clicks to bricks as exemplified by the likes of Warby Parker, Bonobos, Glossier, and Allbirds which plans to open 20 physical locations in 2020. And those are just the ones everybody always talks about.

In China, while online retail sales are expected to reach $1.5 trillion (25% of total retail sales volume), actual growth is starting to slow down as shoppers start to return to the stores. In part, this is due to an increasingly crowded online marketplace, toughening customer acquisition and retention.

Looking ahead

There’s still a long way to go, but the concept is clear. In many parts of the world, several retail giants have suffered since 2014 for being unable to move quickly enough to provide customers with a digital journey that merges with their physical one and vice versa.

It’s now no longer a matter of whether sales come from brick and mortar or online, but rather if brands are getting sales on any of their channels, period.

A new set of investment priorities

54% of BoF-McKinsey State of Fashion Survey respondents said omnichannel integration (+ investing in e-commerce and digital marketing) was top priority for 2019 for third year in a row.

But instead of driving on-device purchases like they were in 2014, investments now include reviewing the omnichannel footprint and reorganization for increased agility at all touchpoints on the journey.

For example, the revival of brick and mortar in China is energizing digitally-powered physical retail innovation, especially in omnichannel fulfillment for customer convenience, with some major online Chinese retailers are going to great lengths to deliver products quickly as well.

Seamless fulfillment will continue to be a challenge for retailers everywhere as customers quickly become accustomed to improvements in their journey. Speedy, one-day or even free shipping is an example of a benefit which is quickly becoming ubiquitous.

Even Amazon, ironically, is facing the challenge of meeting these delivery demands, suffering a drop in earnings for the first time in over two years as it invests in one-day shipping.

For customers, a seamless journey – for retailers, a seamless organization

In the past, retail organizations were divvied up into separate teams, processes, tech, and stock with innovation only taking place in one area: e-commerce.The hard lesson has been that you can’t provide a fully omnichannel shopping journey by stopping there.

As retailers continue to focus on breaking down the silos between online and physical channels, they also need to turn the mirror on themselves to break down silos that separate their own teams.

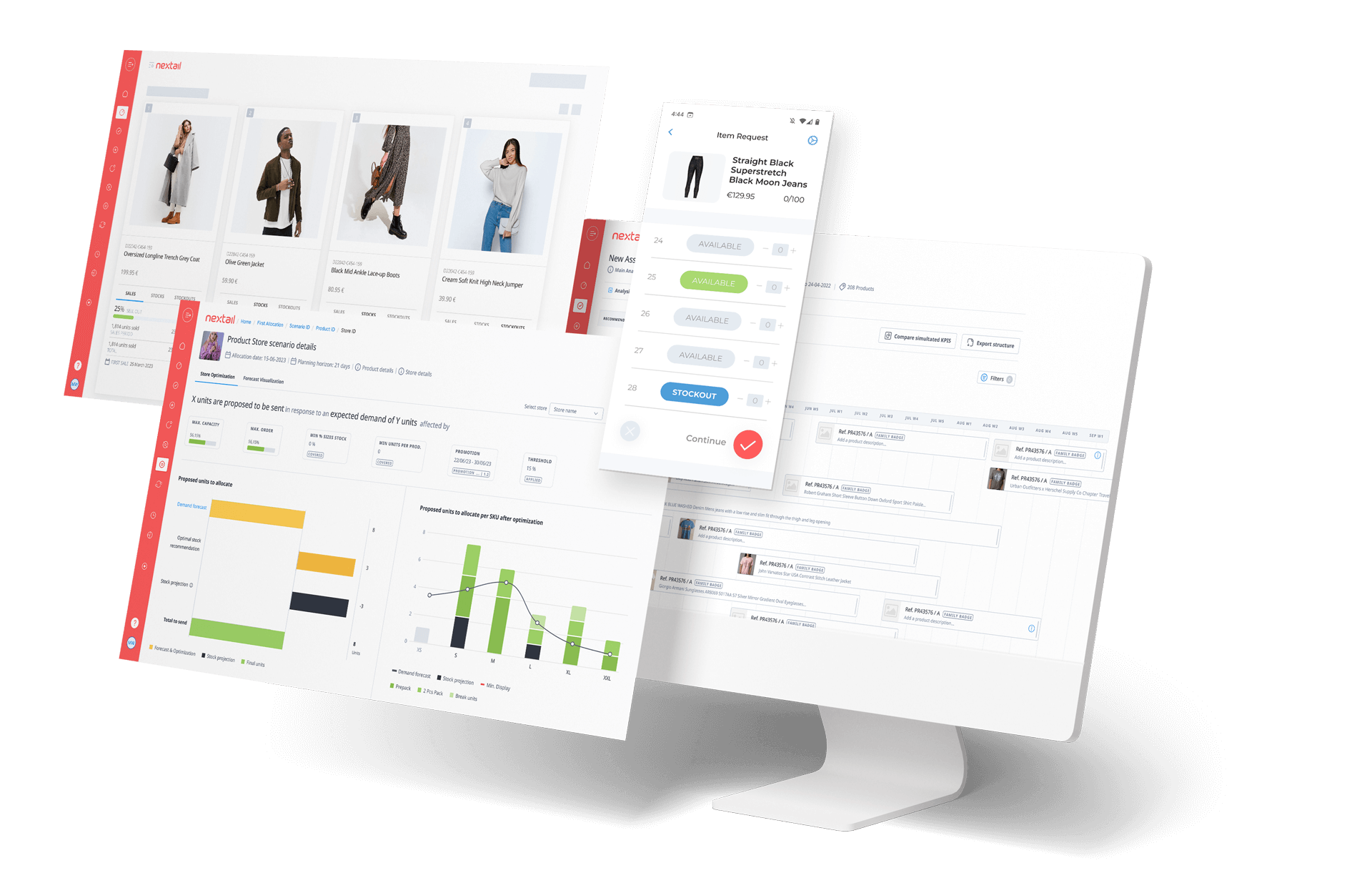

A combination of best-of-breed technology and lean product development approaches will allow for cross-functional teams to make quick decisions to bring products and digital experiences live faster. Increased agility within a brand’s own organization will help ensure that internal bottlenecks and a lack of communication and visibility won’t be the cause of friction.

Not only is the store central to transactions, but also as a gathering point and a place for engagement through experience.

Learn how Flying Tiger Copenhagen has achieved a full, unified view of stock, and is better able to anticipate customer demand on all channels.