Brands race to meet customer needs with AI

Nike’s acquisition of Celect and “data-forwardness” in retail

The Nike acquisition of Celect pays testament to how strongly retailers are betting on AI to transform operations. Not only are budgets for AI projects increasing, retailers are also hiring in more data-related profiles to understand data and to work with third-party solutions in a more meaningful way. We describe how the Nike acquisition of Celect acts as a barometer for the industry’s adoption of AI and levels of “data-forwardness”.

Over the last few years, there’s been a steady climb in retailers adopting, and projected to adopt, AI initiatives. Major recent investments and acquisitions are tangible evidence that more retailers are “suiting up” with tech that lets them meet new customer realities and demands, à la Celect & Nike.

With the ability to automate about half of all retail activities and incorporate insights and data sources that humans can’t, it’s no longer a question of if retailers are going to invest in AI technologies, it’s how much longer they can afford not to.

Untapped applications for AI in operations

Retailers who have already adopted some form of AI have generally focused more of their initiatives and spending on customer-facing AI (74%) with all the bells and whistles like smart chatbots, personalized web search, and startlingly accurate shopping recommendations.

But Capgemini finds that by 2022, retailers can achieve cost savings of up to $340.2 billion by taking AI to scale across operations: procurement, supply chain, logistics, returns, and in-store pilferage.

Leading the way for single-category retailers in AI adoption? Apparel and footwear. Fashion retail is a vertical in which retailers cannot ignore the need to be proactive instead of reactive. Some retailers, like H&M, have had to learn this lesson the hard way.

The Swedish fast-fashion giant has been undergoing a public struggle with ballooning overstock. The brand is just beginning to lasso in its losses thanks to digital transformation projects, including AI and other data analytics initiatives that cover the entire value chain.

In fact, part of H&M’s new mission is to “become the industry leader in advanced analytics and AI”. The retailer has already seen an 11% increase in sales in the first half of 2019. Will other retailers take H&M as an example of how to use innovation to turn things around?

High-profile acquisition makes the news: Nike & Celect

We would be remiss not to address a big-deal business move that’s made major headlines this month. Athletic footwear and apparel giant Nike acquired Boston-based Celect, predictive analytics and demand sensing firm in early August.

According to Nike, acquiring Celect will allow the brand to accelerate its ability to match inventory to customer needs without spending years developing the technology in-house. This acquisition comes after a long line of others, as Nike is investing in both other brands (i.e. Converse, Hurley) and technologies (i.e. Zodiac, Invertex).

It’s interesting to note that Nike opted to fully acquire Celect instead of contract its services through its SaaS model. Will this move fulfil its promise to deliver at scale? Or will corporate culture bog down an independent spirit of innovation? Only time will tell. Here are some of the identified pros and cons.

Either way, Nike’s acquisition of Celect demonstrates an important point: successful retailers recognize the value of AI and machine learning solutions for their businesses, and they’re willing to go to extremes like paying top dollar to acquire such a competitive advantage.

So, for all other retailers out there, how can they leverage AI for the benefit of their own businesses?

Can’t buy a company? Other ways to capture AI’s potential

Of course not all other fashion retailers can, should, or have to “pull a Nike” to improve their operations with AI and machine learning technologies. From what we’re seeing, many brands are opting for other strategies that will enable them to draw insights and act on their data, be it collected internally or through external providers.

The new retail role in hot demand: Data-related profiles

An increasing number of retailers are expanding their teams to include data-related profiles. These professionals can help brands better understand the data they collect from homegrown or external solutions. In this way, brands are creating the right infrastructure to allow them to work with external providers in a meaningful way.

These profiles do come at a cost. Salaries for a Data Scientist in the US tend to fall within the 100–300k USD range (figures from Glassdoor). Depending on whether or not a brand decides to develop in house or to work with third-party providers, it will mean the difference between hiring on an entire team or a few key professionals, respectively.

Thus, a willingness to dedicate a significant portion of budget to data also indicates an interest in fostering a structure of people and services that can capture that potential. In this sense, data-forward retailers understand that with better use of data, they can make faster, more informed decisions to improve their businesses.

Data-related profiles within a retail organization don’t necessarily indicate innovation that takes place solely in-house, but rather an understanding of what can be achieved through data, with the aim of capturing value faster and at a reasonable cost. Sometimes this is done by partnering with experts in certain areas of the brand’s business.

Looking to external providers for speed and flexibility

Retailers are approaching tech solutions and software development in different ways. Some retailers prefer to build tech in-house, and others look outward to meet these needs. The Nike acquisition of Celect is an example of making an external solution internal, but there are plenty of examples in which the two co-exist.

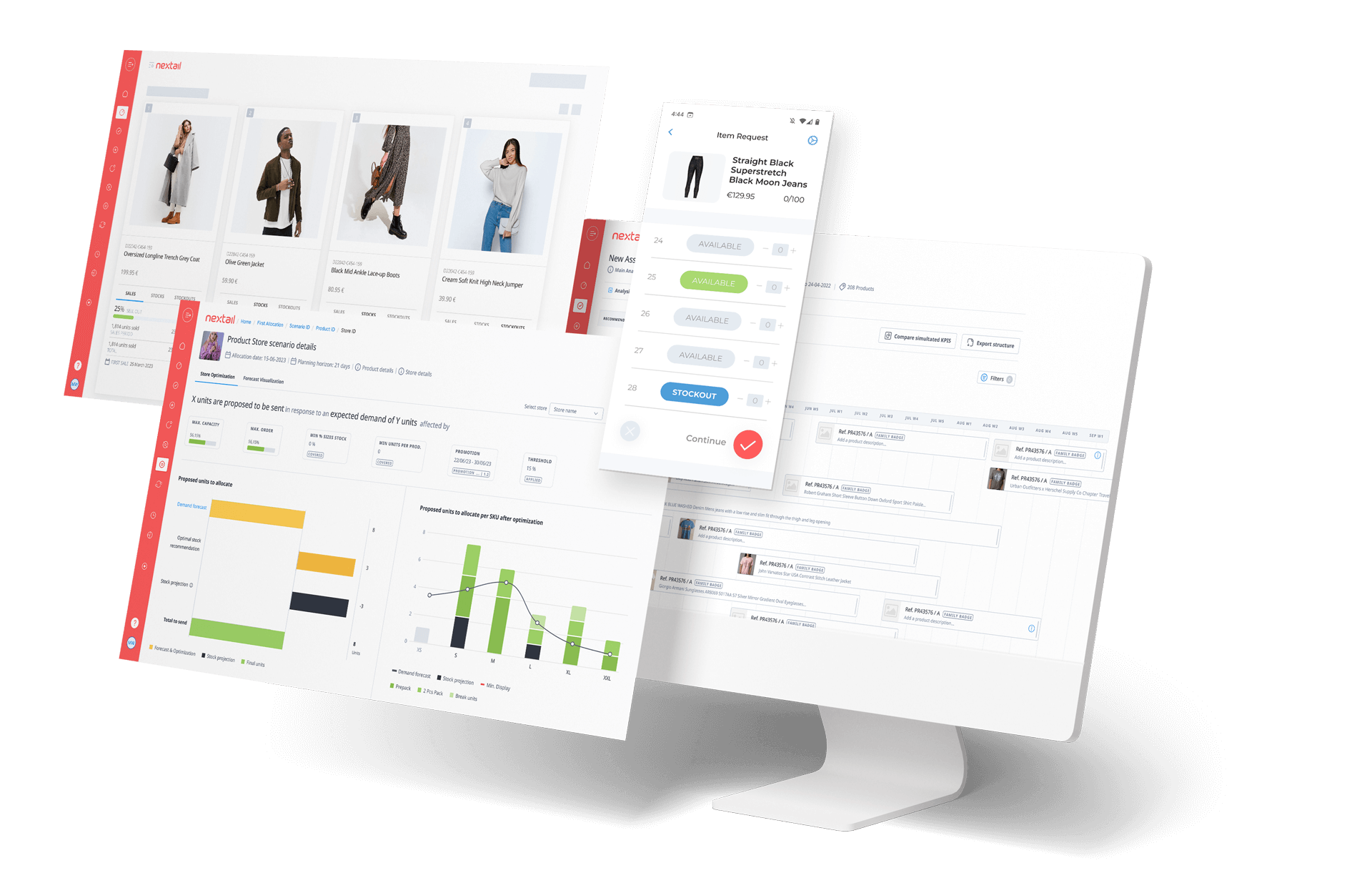

Contracting external providers fully or in part has many benefits. Simply put, doing so is faster, easier, allows for more flexibility, and comes at a lower cost. Given the rush to adopt AI technologies, retailers can truly benefit from external technology, especially when offered through SaaS models.

Methodology

To produce our findings, we used LinkedIn Recruiter to search major brands for individuals currently employed with any of the following job titles: Data Scientist, Machine Learning Engineer, Data Science Manager, Data Science Specialist, Data Engineer, Director Data Science, Head of Data Science, Data Specialist, Data Consultant, Data Manager, Chief Data Officer, Big Data Developer, Head of Data Management, Data Architect.

We then used recent, publicly available annual revenue for each company to calculate each retailer’s number of data employees per billion USD in revenue.